A little update on the current real estate Market Shift below:

What’s going on with the market?

- Less offers written

- Less multiple offers

- Less escalation clauses

- Appraisals are coming in below the purchase price

- Closings are at or slightly below the list price

- More cancellations

- More days on market

- More price reductions

- More transaction disputes

- Inventory is still low but gradually building

Why is this happening?

- June 15: Federal Reserve raised the 30 year fixed mortgage rates by three quarters of a percentagepoint. This has not happened since 1994.

- Inflation is high

- The bond and stock prices plummeted

- Predictions of a possible “modest recession” is speculated later this year or next (not to the magnitude of the Great Recession in 2007 2009).

Inflation is Up

- The general increase in the cost of everyday items leads to a gradualdecrease in purchasing power.

- The Federal Reserve aims to keep the inflation rate at about 2%. But from March 2021 to March 2022, inflation rose 8.5% (food, clothing, housing, etc). This is the biggest jump since December 1981.

- To curb inflation, the Feds started raising interest rates.

- Lower interest rates allow easier access to borrowing (mortgages, personal loans, credit cards). Higher interest rates have the opposite effect.

- Mortgage lenders typically increase their interest rates when the Fed raises their interest rates. Auto loans and variable credit card interest rates will likely increase. Federal student loans have a fixed rate which Congress determines every summer.

- CDs, m

oney market and savings account rates will likely be better.

oney market and savings account rates will likely be better.

How this affects home sales

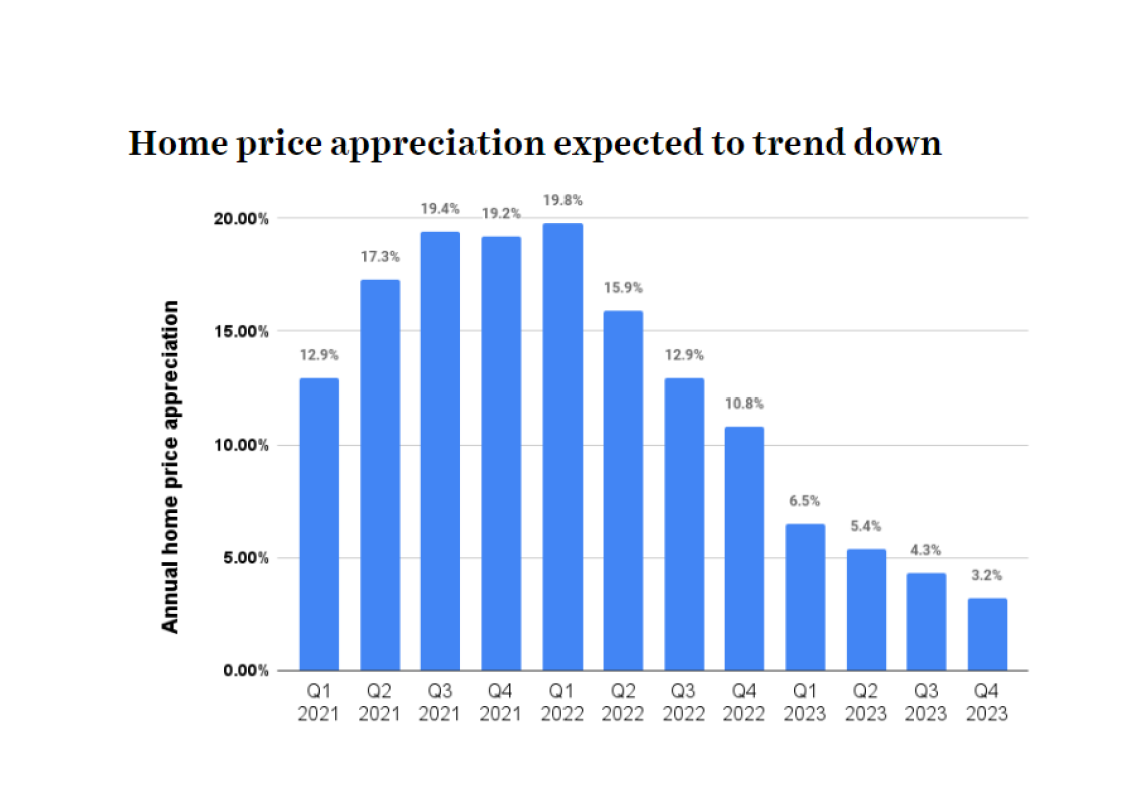

- Fannie Mae’s economists expect to see a large deceleration in home price growth in 2023, with some regions likely to see price declines.

- With the biggest surge in mortgage rates in 40 years, houses are now less affordable than the peak of the 2006 housing bubble.

- This will likely slow home sales in the 3rd and 4th quarters of 2022, followed by a slowdown in new home construction, according to Fannie Mae

Inflection Point?

Inman News: May 26, 2022

- We are on the cusp of an “inflection point”

- When this occurs, it will affect prices, supply, demand and the lives of agents and consumers alike.

- There’s 2 parts of the shift:

1) The freewheeling bonanza of the past two years that was fueled by cheap money and the scales may tip toward buyers

2) A shift is not a collapse. Though rising mortgage rates are cooling the market, the high rates of the 1980’s and 1990’s are not on their way back, nor is a collapse imminent.

The Shift is Happening

Inman News: May 26, 2022

- Evidence of a shift has been mounting for months, but now it feels like it’s everywhere.

- Fannie Mae reported that both homebuilding and home sales are headed for a slowdown.

- Zillow economist Jeff Tucker notes that depending on location the slowdown may already have arrived and rising inventory will give buyers more options this summer

- Redfin Chief Economist Daryl Fairweather states home price drops are climbing in national data. Although there are signs the market is shifting more into buyer’s territory, the market is a long way from the conventional idea of a “buyer’s market.”

- The big driver of these shifts is rising mortgage rates. Rising rates have made housing more expensive and knocked some buyers out of the game.

- Tucker nor anyone else who were interviewed envisions any major price drops in the near future. The rate of appreciation will slow, but that doesn’t mean it will go in reverse.

- A year from now, prices are still expected to be higher than they are now.

A Bubble is Unlikely

Inman News: May 26, 2022

- Jessica Lautz, president of demographics for NAR, noted a bubble is unlikely because of the hot buyer demand that still exists.

- A lot of buyers are waiting for less competition in the marketplace and the trend toward rising rates should slow

- The trend toward low rates is tied to economic conditions: 1) The U.S. becoming a more desirable place for foreign investment, 2) The conditions that led to low rates still exist and are expected to be temporary

- Once the inflation woes are settled, rates will start going in their long term trajectory . . . Down.

- The last two years saw rapidly rising prices with low mortgage rates. But the best time to buy a house is when a person needs a house.

- Builders need to continue building and investing, or homes will remain unaffordable for a large segment of the population.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link